Possible extension of MAP-21 interest rate stabilization

November 08, 2013 - October Three Consulting LLC.

Lawmakers in Washington have a budget problem, and a small part of the

solution being considered is, as we understand it, an extension of interest rate

stabilization relief under 2012's "Moving Ahead for Progress in the 21st Century

Act" (MAP-21). The proposal is to extend the MAP-21 25-year average floor at the

90% level through 2016.

We thought it would be useful, in this context, to review where we are with

MAP-21. We begin with a discussion of the (current) basic MAP-21 rules. Then we

discuss MAP-21 rates and non-MAP-21 PPA rates for 2012, 2013 and 2014. Finally,

we discuss how the extension of MAP-21 relief currently under consideration

would affect plan valuations and (indirectly) funding.

Background

Interest rates matter for ERISA minimum funding because, under the Pension

Protection Act (PPA), the amount an employer must contribute to a plan is

(oversimplifying somewhat) the present value of plan liabilities minus

plan assets (the funding shortfall) amortized over seven years.

Generally, under PPA, valuation interest rates are determined using a corporate

bond yield curve, averaged over 24 months and then broken down into three

segment rates – short-, medium- and long-term. (Pinning down the "PPA rate" can

get complicated, because the sponsor can elect to use a 24-month period ending

on any of 5 months. For purposes of this article, we are simply going to use

August as the ending month for all purposes.)

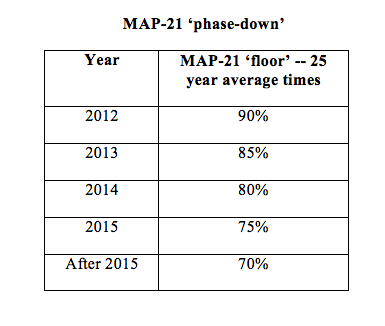

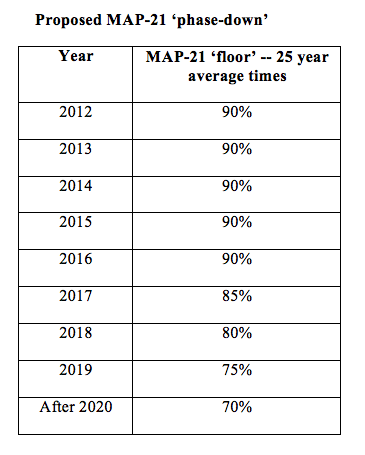

MAP-21 put a "floor" under the PPA rates, equal to the average of rates for

the 25-year period ending in September of the preceding calendar year,

multiplied by a percentage, as follows:

The calculation of the 25-year average is more complicated than it looks --

it is actually a 25-year average of 24-month averages. And (to add more

complexity), IRS used one method to calculate the average in 2012 and changed

that method for years 2013 and after. To keep it simple (or at least simpler),

in this article we're just going to use the ebottom linef numbers. (Note:

because of the way MAP-21 rates are calculated, we already know rates for

2014.)

The MAP-21 floor allows sponsors to use higher interest rates than they would

be able to under the PPA. Higher interest rates = lower liability valuations =

lower minimum required contributions. MAP-21 was included in last year's

transportation bill as a epay-forf because reduced minimum contribution

requirements = lower contributions = lower tax deductions = more revenues. Hence

the continued appeal of proposals to relax funding in the larger context of the

federal budget.

MAP-21 edynamicsf

Let's note a couple of things about the way the MAP-21 interest rate floor

changes. First, it changes once a year, unlike PPA 24-month average rates, which

(in effect) change every month. Second, the floor will go down (in effect, be

less of a floor) each year for the foreseeable future. There are two reasons for

this. First, every year the 25-year average emoves forwardf one year, and as a

result a very high interest rate year (from the late 1980s) is subtracted from

the 25-year average, and a very low interest rate year (e.g., 2013) is added.

Second, until 2015, the percentage multiplier goes down.

Interest rates for the last 25 years and since 2012

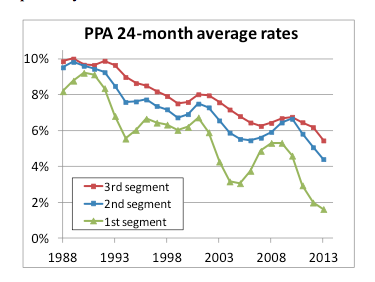

To get a feel for what's going on with the MAP-21 floor, it's worth taking a

look at where interest rates have been. The following chart shows the 24-month

average segment rates under PPA over the past 25 years:

Looking at this chart, it's pretty obvious why averaging interest rates over

25 years provides a efloorf (relative to a 24-month average). Interest rates

have trended down for most of those 25 years.

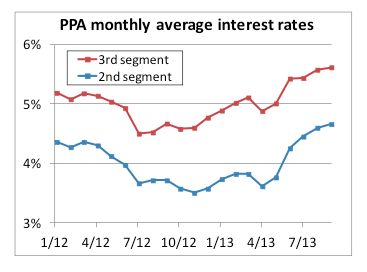

The next chart shows interest rates for 2012-2013 – the period MAP-21 has

been in effect – looking at the monthly average for the key PPA second- and

third-segment rates:

Looking at this chart we can see that, over the past year, interest rates

have gone up about 1%. As rates go up, the MAP-21 efloorf becomes less

significant. But remember, this is a floor relative to a 24-month average –

24-month average rates have not (because they are an average) gone up

the way these spot rates have. As we noted in our recent article MAP-21 and DB plan finance – Looking ahead to 2014, the

MAP-21 floor will still be significantly reducing liability valuations (relative

to pre-MAP-21 rules) in 2014.

2012, 2013 and 2014 rates -- current (PPA+MAP-21) rules

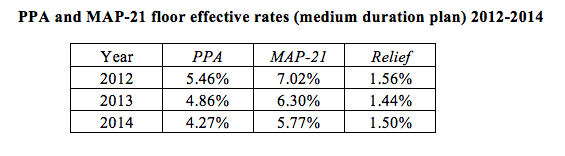

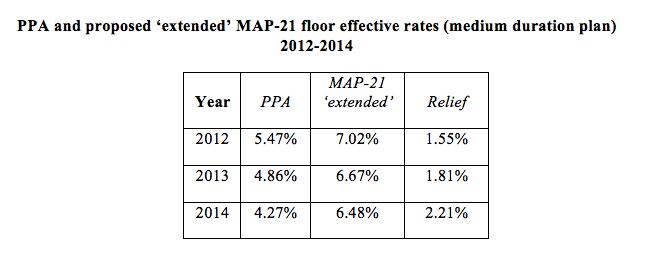

Looking at short-, medium- and long-term segment rates under the PPA and

MAP-21 is a little awkward. It's easier to understand what's going on with

MAP-21 by looking at eeffectivef rates. For the table below we blend segment

rates to create a single rate that would apply to a plan with typical, emedium

durationf demographics – 5% short-term, 60% medium-term and 35% long-term. With

this approach we can compare a single PPA rate to a single MAP-21 rate and show

the difference.

As this table shows, while the MAP-21 floor has gone down over the period

2012-2014, so has the PPA 24-month average. As a result, relative to the

valuation interest rate this typical plan would have been using under the PPA,

MAP-21 has increased the valuation rate by around 150 basis points in each of

the three years 2012, 2013 and 2014. That increase generally reduces the value

of liabilities by around 18%.

For example, assume this plan has $100 million in liabilities and $79 million

in assets under the PPA rules without the MAP-21 floor. Under those rules this

plan would be 79% funded and subject to all the restrictions, etc. that apply to

a plan less than 80% funded. Applying the MAP-21 floor, this plan will be 96%

funded ($79 million divided by $82 million ($100 million minus 18%) = 96%).

Extension of MAP-21

The proposal being discussed as part of a package to end the shutdown would,

as we understand it, revise the ephase-downf schedule as follows:

The table below shows the effect of using a 90% MAP-21 multiplier for years

2012, 2013 and 2014 (years for which we have actual rates).

Over the period 2012-2014, the difference between the PPA rate and the MAP-21

rate actually goes up significantly. The 222 basis point increase in 2014

reduces liabilities, for our typical plan, by 27%. So the plan goes from being

79% funded (under the pre-MAP-21 rules) to being 108% funded ($79 million

divided by $73 million [$100 million minus 27%] = 108%).

Projection

We already know what 2013 and 2014 would look like under the proposed

extension of MAP-21. Let's consider what may happen beyond 2014.

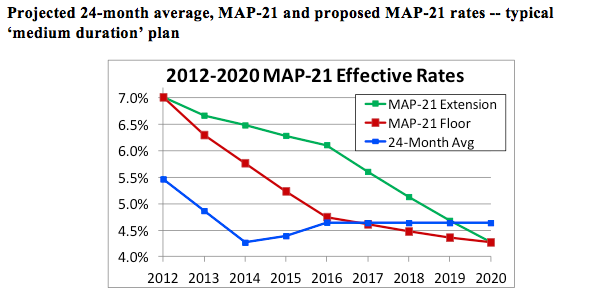

The following chart calculates a single effective rate for our typical

pension plan through 2020 based on (1) PPA 24-month average rates, (2) the

current MAP-21 floor and (3) the proposed extension of MAP-21 rates. (Our

projections are based on rates through October 2013, assuming no future change

in rates).

Projected 24-month average, MAP-21 and proposed MAP-21 rates -- typical

emedium durationf plan

Under these projections, current MAP-21 interest rate relief dwindles after

2015. The extension is expected to provide an additional three years of relief,

through 2018. Of more immediate significance, however, is the additional relief

sponsors would enjoy over the next few years (2013-2015).

* * *

Clearly, the proposal would provide significant additional interest rate

relief -- and greater funding flexibility for sponsors -- for the period

2013-2019. Of course, unless interest rates increase, this sort of relief only

defers funding. At some point, the shortfall in funding will have to be made up.

Under the proposal, during the period 2013-2019, the plan will elook,f for ERISA

minimum funding purposes, more well-funded than it actually is (based on market

interest rates). But, unless those actual, market interest rates go up

significantly, by 2020 (when, in effect, the floor will go away) the real

shortfall will remain and will have to be funded.

The situation in Washington remains unclear, with another potential budget

showdown set for January. Whether extended MAP-21 interest rate relief as part

of a bargain, grand or small, is anybody's guess. But such an extension is in

the Congressional budget etoolkitf as a politically viable epay-for.f

October Three Consulting, LLC is a full service actuarial, consulting and

technology firm that is a leading force behind the reemergence of defined

benefit plans across the country. A primary focus of the consultants at October

Three is the design and administration of comprehensive retirement benefits to

employees that minimize the financial risks and volatility concerns employers

face.

Through effective plan design strategies October Three believes successful

financial outcomes are achievable for employers and employees alike. A critical

element of those strategies is the ReDB™ plan design. The ReDefined Benefit Plan™ represents an entirely new,

design-based approach to retirement and to the management of both the employerfs

and the employeefs financial risk, focusing on maximizing financial

efficiency and employee value.

For more information:

233 South Wacker Drive, Suite 4620

Chicago, IL 60606-4902

info@octoberthree.com

Phone:

312-878-2440

Fax: 866-945-9676

Contact Us